The Eichler Premium: Architectural Consistency and Market Resilience in Silicon Valley Housing

The Architecture of Value

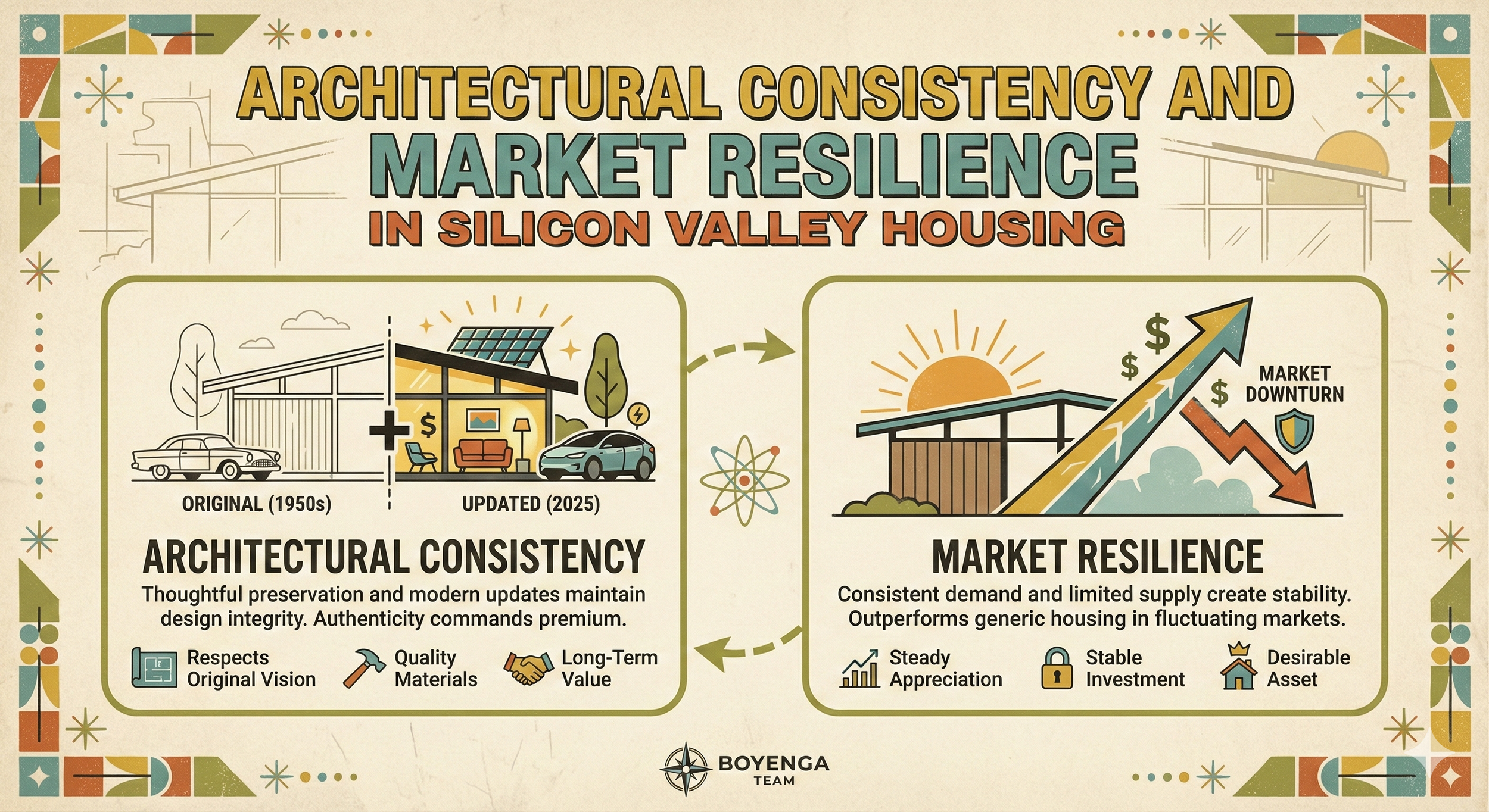

In the volatile landscape of American real estate, few residential sub-markets have demonstrated the resilience and distinct valuation behavior of the neighborhoods developed by Joseph Eichler between 1949 and 1966. While the broader housing market is often subject to fluctuations in interest rates, inventory, and macroeconomic conditions, Eichler neighborhoods in the San Francisco Bay Area and Greater Los Angeles exhibit a distinct economic behavior akin to "blue-chip" collectibles. This report investigates the underlying mechanisms that enable these mid-century modern enclaves to retain and appreciate value during market shifts, positing that their architectural consistency functions not merely as an aesthetic choice but as a robust economic moat that restricts supply, filters for high-capital stewardship, and fosters a community-driven price floor.

The analysis reveals that the value retention of Eichler homes is driven by a convergence of three structural factors: the non-replicability of the asset due to modern building codes and land costs; the sociological cohesion enforced by design guidelines and single-story overlays; and the commodification of "California Modern" lifestyle by a demographic of wealthy, design-conscious buyers who view these homes as art objects rather than mere shelter. By examining historical performance during the 2008 recession and the 2022-2023 market correction, this report establishes that Eichler neighborhoods operate as a distinct asset class, decoupled from the standard depreciation curves of conventional ranch-style tract housing. The data suggest that Eichler homes in prime markets such as Palo Alto and Sunnyvale trade at a significant premium—often 15% to 20% higher per square foot than neighboring ranch homes—driven by a "cult-like" buyer base that values architectural pedigree over standard utility. Furthermore, the high cost of maintenance and restoration acts as a barrier to entry, thereby concentrating ownership among financially resilient households and reducing foreclosure risk during economic downturns.

Chapter 1: The Architectural Genesis and Ideological Foundation

1.1 The Post-War Context and the "California Modern" Vision

To understand the economic resilience of Eichler neighborhoods in the 21st century, one must first analyze the radical departure they represented in the mid-20th century. Following World War II, the United States faced a housing shortage that spurred the mass production of suburban tracts. Developers like William Levitt revolutionized housing through assembly-line techniques, producing thousands of identical Cape Cod or Ranch-style homes. These homes were designed for efficiency and traditional comfort, emphasizing enclosed rooms, attics for storage, and a clear separation between the indoors and the outdoors.

Joseph Eichler, however, was not a builder by trade but a businessman inspired by a personal experience. During World War II, Eichler rented the Sidney Bazett House in Hillsborough, California, a Usonian home designed by Frank Lloyd Wright. This experience of living in a home defined by natural materials, open spaces, and a connection to the landscape fundamentally altered Eichler’s perspective on residential living. He became convinced that the "moral purpose" of homebuilding was to bring high-quality modern architecture—previously the domain of the wealthy custom-home buyer—to the middle class.

This ideological foundation is critical to the asset's long-term value. Unlike his contemporaries, who viewed houses as commodities to be manufactured as cheaply as possible, Eichler viewed his tracts as curated communities. He hired progressive architects, notably Anshen & Allen, Jones & Emmons, and, later, Claude Oakland, to design homes that challenged the status quo. These architects introduced features that were structurally and aesthetically distinct: post-and-beam construction, floor-to-ceiling glass walls, radiant-heated concrete floors, and the signature open-air atrium.

1.2 Structural Innovation as Differentiation

The structural systems employed in Eichler homes were not merely stylistic affectations; they were engineering choices that created a unique living experience impossible to replicate in standard construction.

Post-and-Beam Framing: Unlike standard stud framing, in which walls are load-bearing, Eichler homes used a post-and-beam grid. This allowed interior walls to be non-structural, enabling open floor plans that are now highly sought after by modern buyers. More importantly, it enabled exterior walls to be constructed entirely of glass, thereby dissolving the barrier between the living room and the backyard.

The Atrium: Perhaps the most defining feature of the later Eichler models was the central atrium. This open-air courtyard, enclosed within the house's footprint, created a private outdoor room. It resolved the density paradox: how to provide privacy and light in a subdivision with modest lot sizes. By turning the house inward, Eichler created a sanctuary that felt expansive despite its square footage.

Radiant Heating: Eichler installed hydronic radiant heating systems—copper or steel pipes embedded in the concrete slab—in every home. This system provided an even, silent heat that eliminated the need for bulky ductwork and radiators, preserving the clean lines of the interiors.

The result was a home that lived "larger" than its actual size. A 1,600-square-foot Eichler with sightlines extending through glass walls to the property line feels significantly more spacious than a 2,200-square-foot compartmentalized ranch home. This "perceived volume" is a key factor in the home's valuation, allowing smaller Eichlers to compete on price with larger conventional homes.

1.3 Social Engineering and Community Design

Eichler’s vision extended beyond the individual unit to the community layout. He utilized curvilinear street patterns and cul-de-sacs to reduce through-traffic and foster a sense of safety and community. In developments such as Greenmeadow in Palo Alto and the Highlands in San Mateo, he incorporated communal amenities, including swimming pools, parks, and community centers.

Furthermore, Eichler was a pioneer in fair housing. He famously resigned from the National Association of Home Builders in 1958 over their discriminatory policies and sold homes to Asian and African American families long before it was legally mandated or socially acceptable in the suburbs. This legacy of inclusivity and community orientation established a strong social fabric that persists today. Real estate agents and sociologists often characterize Eichler neighborhoods as "high social capital" zones, in which neighbors share a collective identity rooted in the architecture. This social cohesion acts as a market stabilizer; residents are more likely to invest in their community and less likely to sell during downturns unless necessary, keeping inventory tight and prices stable.

Chapter 2: The Regulatory Moat and Supply Inelasticity

2.1 Title 24 and the Impossibility of Replication

A fundamental tenet of economics is that when prices rise, supply should increase to meet demand. However, the supply of Eichler homes is perfectly inelastic—they cannot be built again. This is not just a matter of land scarcity, but of regulatory prohibition. The specific architectural features that define an Eichler are largely illegal or prohibitively expensive under current California building codes, specifically Title 24.

Title 24, California's energy-efficiency standards, imposes strict limits on the thermal performance of the building envelope. The original Eichler design, with its vast expanses of single-pane glazing and uninsulated 2-inch tongue-and-groove roof decking, would fail every modern energy model.

To replicate an Eichler today, a builder would face immense challenges:

Glazing: The hallmark floor-to-ceiling glass must now be double-paned, tempered, and Low-E coated to meet U-factor requirements. The framing for such heavy glass requires thermally broken aluminum or fiberglass systems, which cost substantially more than the simple wood or thin aluminum stops used in the 1950s.

Roofing: The thin, floating roofline is difficult to achieve with modern insulation requirements. Achieving R-30 or R-38 insulation values typically requires building up the roof deck with thick rigid foam, which alters the fascia profile and necessitates costly detailing to preserve the mid-century aesthetic.

Structural Codes: Modern seismic codes require shear walls to resist lateral forces. The "walls of glass" design of an Eichler often lacks sufficient shear strength by modern standards, requiring the installation of expensive steel moment frames to maintain the transparency.

2.2 The Replacement Cost Ceiling

Because of these regulatory hurdles, the "replacement cost" of an Eichler home has skyrocketed. Construction cost estimates for custom mid-century modern homes in the Bay Area in 2025 range from $500 to over $1,200 per square foot.

Table 1: Estimated Cost to Build a Custom Modern Home (Bay Area · 2025)

Site Prep & Foundation:

$65 – $130 per sq. ft.

Grading, slab foundation, and radiant-heat preparationFraming (Post & Beam):

$100 – $200 per sq. ft.

Heavy timber construction with steel connectorsExterior (Glass & Siding):

$80 – $150 per sq. ft.

Custom double-pane glazing and modern exterior materialsSystems (MEP):

$100 – $200 per sq. ft.

High-performance HVAC, electrical, and plumbing systemsInterior Finishes:

$150 – $400+ per sq. ft.

Cabinetry, flooring, fixtures, and finish carpentrySoft Costs:

20–30% of total project cost

Architecture, engineering, permits, and consultingTotal Estimated Build Cost:

$500 – $1,200+ per sq. ft.

Land cost not included

Data aggregated from

For a standard 2,000-square-foot home, the construction cost alone would range from $1 million to $2.4 million. When land costs in prime areas like Palo Alto or Sunnyvale (often $2 million+) are added, the total cost to create a new Eichler-style home far exceeds the market price of existing renovated Eichlers. This creates a "value gap" in which purchasing an existing Eichler, even at a premium, is significantly cheaper than replicating it. This replacement cost ceiling provides a hard floor for valuations; as construction costs rise, the value of existing stock is pulled upward.

2.3 Scarcity and the "Limited Edition" Asset

With roughly 11,000 Eichlers in existence and a significant number having been altered or demolished over the decades, the supply of "authentic" Eichlers is shrinking. In economics, a shrinking supply of a desirable asset leads to price appreciation that is decoupled from general market trends.

The "original" Eichler is increasingly viewed as a "limited edition" collectible. Buyers are not just purchasing 4 bedrooms and 2 bathrooms; they are purchasing a verified work of mid-century design. This creates a market dynamic similar to that of vintage cars or art, in which provenance and rarity drive value more than functional utility. An Eichler with its original unpainted redwood ceiling and mahogany panels commands a premium over a remodeled one because those materials are either unavailable or prohibitively expensive to source today.

Chapter 3: The Economics of Aesthetics and Maintenance

3.1 The "Filter" of High Stewardship Costs

One counterintuitive reason for the stability of Eichler neighborhoods is the high cost of ownership. These homes are not "low maintenance." They require specialized care that serves as a financial filter, ensuring that the owner base comprises individuals with significant disposable income and liquidity.

Radiant Heating: The original radiant heating systems often fail after 50+ years. Repairing slab leaks or replacing the boiler is costly. Abandoning the system for mini-splits changes the aesthetic. A fully functioning, updated radiant system is a major value driver, but maintaining it requires specialized technicians.

Flat or low-pitch roofs require vigilant maintenance to prevent leaks. Modern foam roofing systems (SPF) are the gold standard for Eichlers, providing insulation and waterproofing, but a new foam roof can cost $20,000 to $40,000, depending on the size and thickness.

Glass: The single-pane glass is thermally inefficient. Replacing it with double-pane glass while maintaining the original design's slim sightlines is a custom job. Generic vinyl windows "ruin" the value, so owners must pay for expensive aluminum or fiberglass replacements.

Table 2: Estimated Renovation Costs for an Eichler (2024 Estimates)

New Foam Roof:

$15,000 – $25,000

Essential for proper insulation and waterproofingWindow Replacement:

$40,000 – $80,000

Custom double-pane, floor-to-ceiling glass to preserve Eichler proportionsRadiant Heat / HVAC:

$30,000 – $50,000

Boiler replacement or conversion to ductless mini-splitsElectrical Upgrade:

$25,000 – $40,000

200-amp panel upgrade and full or partial rewiringKitchen Remodel:

$100,000 – $150,000

Custom cabinetry typically required to maintain mid-century aestheticsTotal Core Renovation (Estimated):

$300,000 – $500,000+

Excludes cosmetic finishes, furnishings, and landscape work

This high "cost of entry" and "cost of stewardship" discourages speculative flippers and marginal buyers. The demographic that buys into Eichler neighborhoods is typically financially robust, often with dual tech incomes or significant equity from previous homes. This financial resilience means that during economic downturns, Eichler owners are less likely to default or be forced into distressed sales, preventing the inventory flooding that crashes prices in less affluent neighborhoods.

3.2 The Renovation Paradox: Authenticity vs. Modernization

The valuation of Eichler homes presents a paradox: the highest prices are paid for homes that are either impeccably preserved "time capsules" or thoughtfully modernized in ways that respect the original architecture. Homes that have been "remuddled"—characterized by the addition of crown molding, generic colonial doors, or the painting of redwood beams—often trade at a discount.

This "purist premium" creates a distinct investment logic. In a standard home, updating a kitchen with trendy finishes usually yields a positive ROI. In an Eichler, removing the original cabinetry to install a generic Shaker-style kitchen can destroy value. This forces owners to be thoughtful and often spend more on high-quality, architecturally appropriate materials (e.g., walnut cabinetry, terrazzo floors). This elevated standard of renovation increases the neighborhood's aggregate value over time, as the housing stock is progressively upgraded to "luxury" standards rather than "commodity" standards.

3.3 Insurance Challenges

A growing challenge for Eichler owners is securing homeowners’ insurance. Because the replacement cost of an Eichler is higher than that of a standard home (due to slab debris removal and the complexity of post-and-beam reconstruction), insurers often require higher coverage limits. Some owners report needing coverage of $600 per square foot to be adequately protected. Additionally, many Eichler tracts are located in areas with wildfire risks (e.g., Lucas Valley, Oakland Hills). While this increases holding costs, it paradoxically reinforces the neighborhood's exclusivity, as only those who can afford the high premiums can purchase.

Chapter 4: Neighborhood Cohesion and Legal Protections

4.1 Single Story Overlays (SSO) and Privacy

One of the most critical factors in Eichler value retention is the legal protection of the neighborhood's character. Because Eichler homes are designed with glass walls, privacy is maintained only if neighbors cannot peer into one's atrium or backyard. A two-story addition next door effectively destroys the utility and value of an Eichler home.

Recognizing this, communities in Palo Alto, Sunnyvale, and Cupertino have advocated for and established Single-Story Overlay (SSO) zones. These zoning ordinances prohibit second-story additions, thereby locking in the neighborhood's single-story character. While restrictions on development rights usually lower land values, in Eichler neighborhoods, SSOs increase them. They provide buyers with certainty that their investment will not be degraded by incompatible development. A buyer spending $3 million on a glass house needs the assurance that their privacy is legally protected. The SSO provides that assurance, turning the neighborhood into a protected enclave.

4.2 Historic Districts and Tax Incentives

Beyond zoning, some Eichler neighborhoods have been designated as Historic Districts. The city of Orange, for example, has designated Eichler tracts as historic districts, allowing owners to apply for the Mills Act. The Mills Act is a state law that authorizes local governments to enter into contracts with owners of qualified historic properties, providing a reduction in property taxes in exchange for the continued preservation of the property.

For a home assessed at $1.5 million, the Mills Act can save an owner $6,000 or more annually in property taxes. This capitalization of tax savings into the home's value creates a higher price floor. Furthermore, the historic designation serves as a badge of honor, validating the home's architectural significance and attracting buyers specifically looking for "pedigree" properties. Data from Orange indicate that these districts have experienced a "huge escalation in property values" and improved maintenance standards, as owners reinvest tax savings into restoration.

4.3 The Network Effect of Homogeneity

Standard real estate wisdom suggests that variety adds interest to a neighborhood. In Eichler tracts, consistency is the value driver. The repetition of rooflines, the consistent setback, and the uniform modern aesthetic create a powerful visual identity. This "brand consistency" makes the neighborhood recognizable and desirable. It functions like a luxury brand; just as a Mercedes dealership maintains a consistent aesthetic to signal quality, an Eichler neighborhood's visual uniformity signals a specific, high-value lifestyle.

This consistency creates a network effect. When one neighbor restores their home, it enhances the value of the entire street. Because the architecture is uniform, the "comps" (comparable sales) are tighter and more reliable, giving appraisers and lenders confidence in valuations. This reduces the volatility seen in eclectic neighborhoods where pricing can be idiosyncratic.

Chapter 5: Market Performance Analysis (2008 & 2022)

5.1 The Great Recession (2008-2011): A Stress Test

The 2008 financial crisis provides a critical historical test case. While national home values fell by 15-20% and some California markets (like the Central Valley) saw declines of over 50%, Eichler neighborhoods in prime locations demonstrated remarkable resilience.

In Palo Alto, where Eichler tracts like Greenmeadow are located, the market softened but did not collapse. While transaction volume declined, prices recovered more rapidly than the national average. By 2012, Palo Alto median home prices had increased 20.9% year over year, effectively erasing the recessionary losses and setting new highs.

Why the Resilience?

Low Subprime Exposure: In 2008, Eichler owners were typically long-term residents with significant equity or high-income professionals who were not reliant on subprime products.

The "Flight to Quality": In uncertain times, capital flees to quality. Cash buyers viewed the dip as a rare opportunity to purchase into premier neighborhoods that were previously unaffordable. The scarcity of the asset meant that even in a down market, there was a floor of demand from "waiting list" buyers.

Land Value: The underlying land value in these neighborhoods (close to jobs and high-quality schools) provided a high baseline valuation, reducing downside risk relative to exurban tracts.

5.2 The 2022-2024 Market Correction

The post-pandemic market, characterized by a rapid rise in interest rates from 3% to over 7%, froze the housing market nationwide. Affordability collapsed, and inventory dried up as sellers with low rates refused to sell. However, Eichler neighborhoods outperformed the general market in this environment as well.

In Silicon Valley, while general inventory rose and days-on-market increased to 20-25 days, Eichler listings remained scarce and fast-moving. In 2024, Eichlers in Sunnyvale (94085) averaged just 10-12 days on the market and sold for ~110% of the list price, compared to ~102% for the general market.

Table 3: 2024 Market Performance Comparison (Silicon Valley)

Eichler Enclaves (e.g., Sunnyvale)

Average Days on Market: ~10–12 days

Sale-to-List Price Ratio: ~110% (≈10% over asking)

Overbid Frequency: ~87% of sales

Price Trend (Year-over-Year): +9–10%

General Silicon Valley Market

Average Days on Market: ~20–25 days

Sale-to-List Price Ratio: ~102% (≈2% over asking)

Overbid Frequency: ~50–60% of sales

Price Trend (Year-over-Year): Flat to slight decline

This data indicates a decoupling of the Eichler market from standard affordability metrics. The buyers in this segment are often cash-heavy tech workers or move-up buyers rolling over significant equity, making them less sensitive to interest rate hikes. The "Eichler Premium" actually expanded during this period, as the desire for high-quality, work-from-home-friendly environments (the atrium) outweighed financial headwinds.

5.3 Eichler vs. Ranch: A Comparative Case Study

When directly compared to standard ranch homes in the same zip codes, Eichlers command a significant premium. In Mountain View’s Monta Loma neighborhood, Eichler homes consistently sell for $1,500-$2,000 per square foot. In contrast, non-Eichler mid-century homes in the same area trade at approximately $1,200- $1,300 per square foot.

This spread—roughly 20-30%—is the monetary value of the "Eichler Brand." A Mackay home (a close competitor) is highly valued but often trades at a slight discount to a true Eichler because it lacks the same level of brand recognition and architectural "purity" (often featuring more conventional garages or layouts). This suggests that the market values the specific Eichler signature, not just mid-century design in general.

Chapter 6: Geographic Micro-Market Analysis

6.1 Palo Alto: The Gold Standard

Palo Alto represents the apex of the Eichler market. Neighborhoods such as Greenmeadow and Green Gables are not merely housing tracts but also historic landmarks. Greenmeadow, with its community center and pool, functions as a private village. Prices here range from $3 million to over $5 million for homes that are often less than 2,000 square feet.

The resilience here is driven by the extreme scarcity of entry. With only ~2,200 Eichlers remaining in Palo Alto and strict preservation guidelines, the supply is effectively capped. The proximity to Stanford University and major tech HQs ensures a permanent oversupply of qualified buyers. During the 2022 correction, Greenmeadow prices remained robust, with some homes selling for 23% over list price even in a "cool" market. The "Blue Chip" status of Palo Alto real estate, combined with the Eichler collector value, creates an asset that is virtually immune to standard market fluctuations.

6.2 San Jose: The Accessible Enclave

In San Jose, the Fairglen neighborhood in Willow Glen offers a slightly more accessible price point but exhibits the same resilience dynamics. Fairglen is known for its strong community spirit, including annual block parties that are legendary in the Eichler world.

Prices in Fairglen have surged from the $1.3 million range to over $2.3 million in recent years. A rare "Double A-Frame" model in Fairglen sold for $2.35 million in 2024, setting a record and demonstrating that "trophy" assets within the tract can command prices well above the neighborhood median. The cohesion of Fairglen, protected by a dedicated neighbor network, prevents the "broken window" effect; even during downturns, the neighborhood appears pristine, supporting property values.

6.3 Marin County: Nature Integration

Lucas Valley in Marin County represents the Eichler ideal of "nature integration." The Upper Lucas Valley tract is famous for its underground utilities (no power lines), strict architectural review board, and scenic backdrop.

Eichlers here typically sell between $1.85 million and $2.6 million. The value proposition in Lucas Valley is heavily tied to the preservation of the landscape and the architectural uniformity. Because the HOA is extremely strict about exterior modifications, buyers have high confidence in the long-term stability of the neighborhood's aesthetic. The absence of "bad remodels" keeps the average sales price high.

6.4 Oakland: The Hillside Adaptation

Sequoyah Hills in Oakland presents a unique case study. Unlike the flat tracts of the Peninsula, these Eichlers are built on hillsides, requiring different engineering and layouts. These homes often feature dramatic views and more complex vertical massing.

Historically undervalued compared to Palo Alto, Sequoyah Hills has seen rapid appreciation as buyers priced out of the Peninsula seek value. The "Lost Eichlers" of Oakland are now recognized as architectural gems, with prices moving into the $1.6M-$1.8M range. This "catch-up" appreciation demonstrates how the Eichler brand can lift values in secondary markets as awareness spreads.

6.5 Southern California: Orange County

In the city of Orange, the Fairhaven, Fairmeadow, and Fairhills tracts have been designated as Historic Districts. This legal designation has been a game-changer for value retention. By unlocking the Mills Act tax incentives and enforcing preservation, Orange has experienced a renaissance in restoration. Property values have escalated significantly as the housing stock has improved in quality and authenticity. The "Orange" case proves that municipal support for preservation is a direct driver of economic value.

Chapter 7: The Sociology of the Premium

7.1 The Millennial and Tech Connection

A key driver of recent Eichler appreciation is the demographic shift in buyers. Contrary to the idea that mid-century homes are for an older generation, Millennials and Gen Z buyers are aggressively targeting Eichlers.

This demographic, heavily represented in the Silicon Valley tech sector, aligns philosophically with Eichler design. The aesthetic—minimalist, transparent, functional, and integrated with nature—mirrors the design ethos of modern technology companies (e.g., Apple). Steve Jobs famously grew up in a mid-century home and cited it as an inspiration for his appreciation of simple, mass-produced design. For a young tech worker, living in an Eichler is a lifestyle statement that aligns with their professional identity.

7.2 "The Eichler Network" and Cult of Stewardship

Eichler ownership is not a passive investment; it is an identity. The existence of the "Eichler Network"—a magazine, website, and service provider directory dedicated solely to these homes—creates a support infrastructure that few other housing types possess.

This ecosystem educates homeowners about the value of their homes, provides resources for restoration, and discourages value-destroying renovations. It turns homeowners into curators. When a neighborhood views itself as a collection of curators rather than just residents, the standard of maintenance rises, boosting the curb appeal and value of the entire tract. This "cult" status ensures a steady stream of enthusiastic buyers who are willing to pay a premium to join the club.

Chapter 8: The Renovation Paradox

8.1 The Economics of Restoration

Renovating an Eichler is a high-stakes financial endeavor. Because of the specialized construction, costs are higher than average. A full renovation can cost $300-$600 per square foot. However, the Return on Investment (ROI) for "correct" renovations is substantial.

The market penalizes "Home Depot" renovations—installing generic materials that clash with the modernist aesthetic. Conversely, it heavily rewards "purist" restorations. Restoring the original mahogany paneling, updating the radiant boiler (rather than abandoning it), and installing high-end architectural glazing can yield returns of 200-300% on the cost because these features attract the highest-tier buyers.

8.2 The "Remuddled" Discount

Homes that have been altered insensitively—atriums enclosed to make a larger living room, roofs pitched to look like a ranch style—often sit on the market longer and sell for less. This pricing mechanism reinforces preservation. It sends a clear economic signal to owners: Preserve the architecture to preserve your wealth. This alignment of aesthetic integrity and financial incentive is the core engine of Eichler market resilience.

Chapter 9: Comparative Asset Classes

9.1 Eichler vs. Mackay and Other Mid-Century Homes

Eichler was not the only builder of mid-century homes. Builders such as Mackay and Bahl also developed modern tracts in the Bay Area. While these homes are desirable, they typically trade at a discount to Eichlers.

Mackay homes, for example, often featured more conventional elements like standard garages and forced-air heating, which makes them easier to maintain but less "iconic". The "Eichler" name carries a brand premium, much like "Kleenex" or "Google." Buyers will pay more for the "real thing." In 2024, while a Mackay might sell for $2.5 million in a good neighborhood, a comparable Eichler could command $2.8 million+, solely due to the brand cachet and the fanaticism of the buyer base.

9.2 Eichler vs. The Standard Ranch

Compared to the standard postwar ranch home, the Eichler is a distinct asset class. A ranch home is a commodity; it competes on square footage, bedroom count, and school district. In a recession, commodity prices are subject to price wars.

An Eichler is a differentiated product. It offers a lifestyle (atrium living, glass walls) that a ranch home cannot replicate. Therefore, it has pricing power. In a down market, a buyer seeking an Eichler will not settle for a ranch, keeping demand concentrated on the limited Eichler supply and supporting prices even as the broader market softens.

Resilience of Eichler neighborhoods

The resilience of Eichler neighborhoods during market shifts is the result of a complex interplay between architectural scarcity, regulatory barriers, and social capital.

The homes function as non-fungible assets. In a downturn, a buyer can find a cheaper 4-bedroom house, but they cannot find a cheaper Eichler. The impossibility of replicating these homes under modern codes creates a permanent supply cap. The high cost of stewardship acts as a financial stress test, ensuring that owners are well-capitalized and neighborhoods remain stable.

Furthermore, the "cult" of stewardship, reinforced by legal protections such as SSOs and Historic Districts, ensures that asset quality does not degrade over time. As long as Silicon Valley values innovation, design, and history, the Eichler home will remain a "blue-chip" investment, offering shelter not only from the elements but also from market volatility.

Key Takeaways

Regulatory Scarcity: Title 24 and construction costs make "new" Eichlers impossible to build at scale, locking in the value of existing stock.

The "Purist" Premium: The market rewards preservation and penalizes insensitive renovation, aligning aesthetic and financial incentives.

Neighborhood as Moat: SSOs and Historic Districts protect the collective value of the tract, reducing investment risk.

Demographic Alignment: The tech-centric Millennial cohort generates sustained, high-income demand for the specific "Eichler lifestyle."

Recession Resistance: High owner equity and the "flight to quality" kept Eichler prices stable during 2008 and 2022,

outperforming the broader housing market.

The Boyenga Team at Compass is recognized as Eichler and Mid-Century Modern specialists, representing buyers and sellers across Silicon Valley’s most architecturally significant neighborhoods, including Palo Alto, Sunnyvale, San Jose, Marin, and the East Bay.

Led by Eric and Janelle Boyenga, the team approaches Eichler homes not as generic housing, but as architectural assets requiring design-literate valuation, preservation-aware marketing, and deep neighborhood knowledge. Their work emphasizes architectural integrity, regulatory nuance (Single-Story Overlays, historic districts, HOA design standards), and buyer psychology unique to mid-century modern properties.

By combining Compass’s data-driven marketing platform with decades of hands-on Eichler experience, the Boyenga Team helps clients navigate renovation decisions, pricing strategy, and long-term value preservation—whether selling a time-capsule Eichler, a thoughtfully restored modernist home, or acquiring a rare architectural original.

📚 Eichler Homes · Architecture · Design · Market Intelligence

🏡 Eichler Value, Culture & Market Behavior

Why a Palo Alto Eichler Is More Than a Home — It’s a Blue-Chip Investment

Why I’ve Called a Palo Alto Eichler Home for 30 Years (And Why You Might Want To)

Which Eichler Homes Sell for More? Price Trends by Model & Roofline

🧱 Architecture, Construction & Design Integrity

How to Insulate an Eichler Roof Without Ruining the Ceilings

Eichler Siding Replacement: Matching Original Groove Patterns